Q: My transactions keep failing due to too much slippage. How do I fix this?

- 1klick0

- Nov 14, 2024

- 2 min read

Updated: Nov 17, 2024

Trading slippage refers to the difference between a trade's expected price and the price at which it is actually executed. If there is insufficient liquidity at the current bid or ask price to cover an order, the price will "slip" to find more willing buyers or sellers.

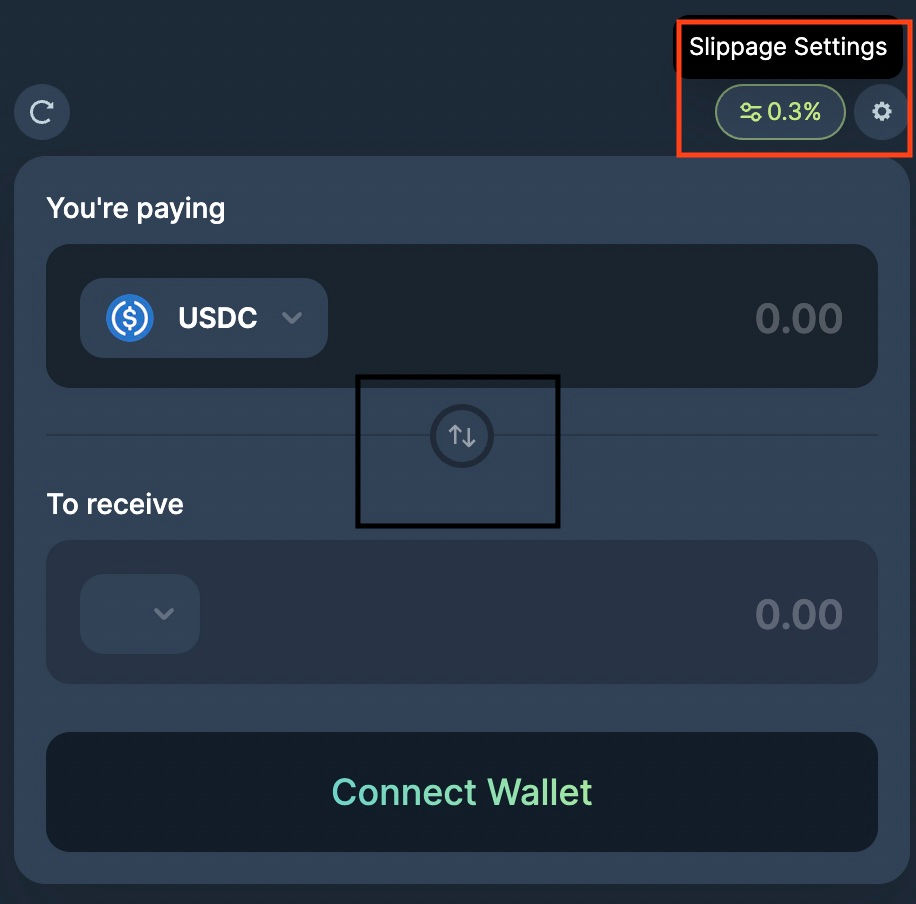

Exchanges limit the amount of allowable slippage to prevent you from accidentally losing a lot of money. The default slippage is typically 0.3%, but a lot more is needed to execute a transaction if you are trading meme coins.

Meme coins are highly illiquid, so you'll need a high slippage rate to complete the transaction. Meme coin trading tools like Photon and Telegram bots usually default to about 25%, but most exchanges and meme coin trading apps allow you to customize the slippage in the settings.

Once you've increased your slippage, your transactions should start executing.

If you continue to see slippage errors, there might be another issue. Sometimes, meme coin creators remove all the liquidity from the coin's automated market maker. If a coin has no liquidity, selling any amount of it will drop the price by 99%, so even a 25% slippage rate will result in an error. If a meme coin has no liquidity, it generally means it has no value.

Here are some meme coin trading tools that will help you protect yourself against future rug pulls.

Jupiter recently added a new feature called Dynamic Slippage that helps people execute trades with the lowest amount of slippage possible. When turned on, Dynamic Slippage automatically calculates the optimal slippage amount so your trade goes through with the best price. You can turn on this feature by clicking the Slippage Options button in the top right of the token swap screen.